south carolina inheritance tax rate

The following five states do not collect a state sales tax. As used in this chapter.

South Carolina Sales Tax On Cars Everything You Need To Know

Like estate taxes and inheritance taxes South Carolina also does not have a gift tax.

. South Carolina Income Tax Calculator 2021. Even though there is no South Carolina estate tax the federal estate tax might still apply to you. Any excess over the exemption amount is applied at a rate of 40.

However there are 2 important exceptions to this rule. Detailed South Carolina state income tax rates and brackets are available on. If you make 70000 a year living in the region of South Carolina USA you will be taxed 12409.

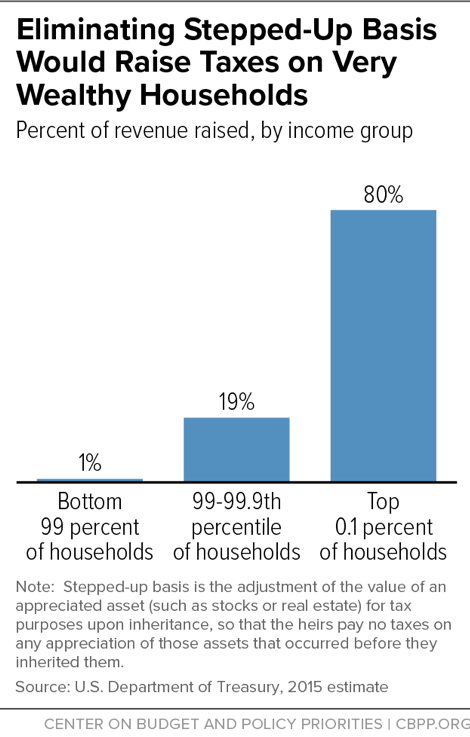

In the United States the estate tax is a major source of revenue for state and local governments. Federal Estate Tax. Like estate taxes and inheritance taxes South Carolina also does not have a gift tax.

Not every state imposes the Inheritance Tax and South Carolina is one of many that does not. Your federal taxable income is the starting point in determining. This chapter may be cited as the South Carolina Estate Tax Act.

Tax rate of 0 on the first 3199 of taxable income. Tax rate of 3 on taxable income between 3200 and. The South Carolina income tax has six tax brackets with a maximum marginal income tax of 700 as of 2022.

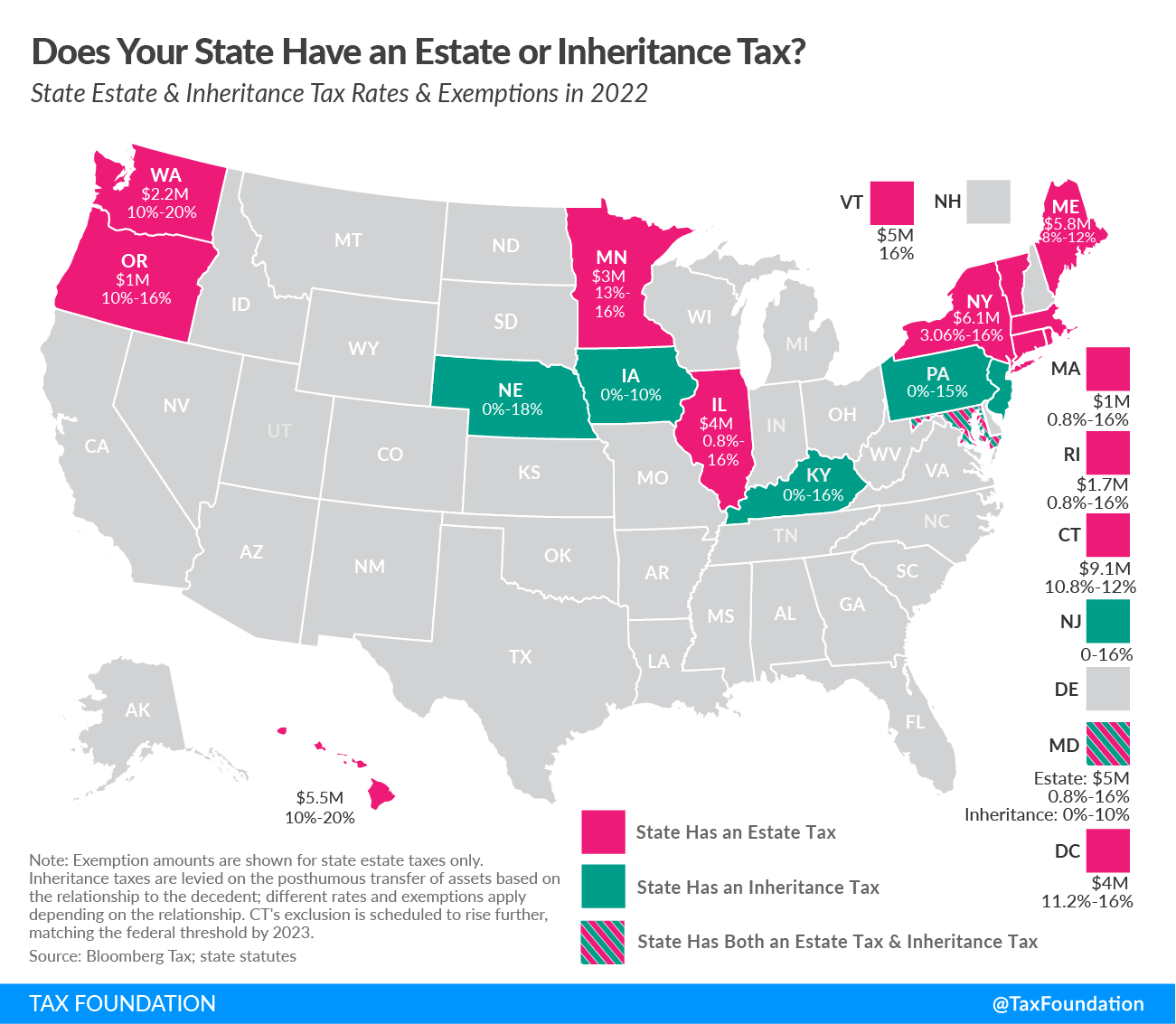

However some of these states find ways to collect taxes in. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state.

In January 2013 Congress set the estate tax exemption at 5000000. For single taxpayers living and working in the state of South Carolina. The top estate tax rate is 16 percent exemption threshold.

South carolina does not levy an inheritance or. South Carolina Inheritance Tax 2020. For decedents dying in 2013 the figure was 5250000 and the 2014 figure is 5340000.

What is South Carolina inheritance tax rate. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications.

On the one hand it makes the states estate planning and inheritance procedure easier. Your average tax rate is 1198 and your. The federal estate tax exemption is 117 million in 2021.

There are no inheritance or estate taxes in South Carolina. Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the. Still individuals who are gifted more than 15000 in one calendar year are subject to the.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Alaska Delaware Montana New Hampshire and Oregon. South Carolina has no estate tax for decedents dying on or after January 1 2005.

Does South Carolina Have an Inheritance Tax or Estate Tax. South Carolina also does not impose an Estate Tax which is a tax taken from the.

State Taxes On Capital Gains Center On Budget And Policy Priorities

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Retirement Tax Friendliness Smartasset

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

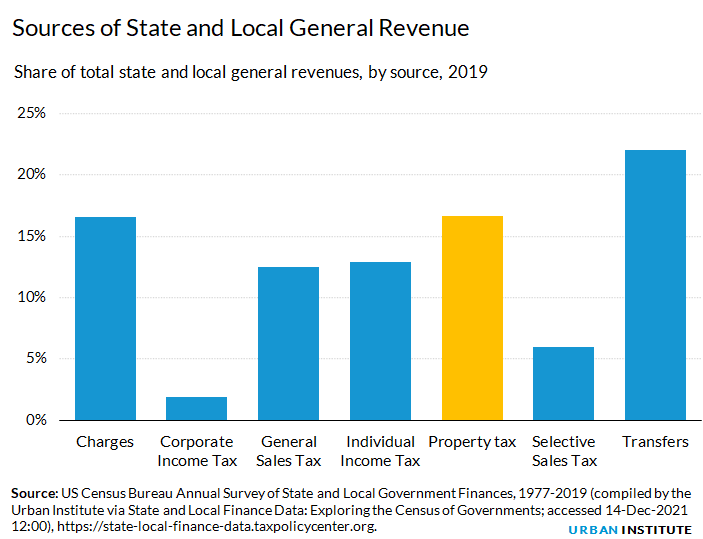

Individual Income Taxes Urban Institute

Florida Vs South Carolina For Retirement Which Is Better 2020 Aging Greatly

2021 State Corporate Tax Rates And Brackets Tax Foundation

Property Taxes Urban Institute

:max_bytes(150000):strip_icc()/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

Your Columbia Sc Real Estate Questions Answered

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

States With The Highest Lowest Tax Rates

Estate And Inheritance Taxes By State In 2021 The Motley Fool

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

State Tax Levels In The United States Wikipedia

A Guide To South Carolina Inheritance Laws

North Carolina Or South Carolina Which Is The Better Place To Live